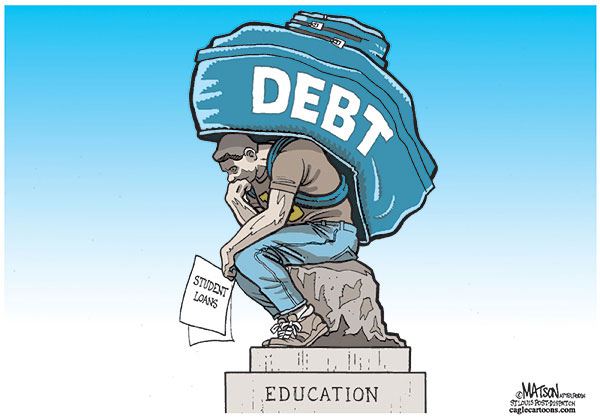

According to the Federal Reserve Board of New York, there are approximately 37 million Americans who have outstanding student loans. Faced with a slower economy and mounting debt, many individuals are extremely worried about how they'll ever repay their loans. If you're struggling with similar concerns, here are five things you should know about student loan forgiveness and other debt solutions:

1) Certain jobs will give you the possibility of loan forgiveness

As discussed in this article from USA Today, depending on the kind of loan you took out, working at certain jobs does give you the possibility of loan forgiveness. With public service jobs in the government or in tax-exempt (and some non-exempt) non-profits, the remainder of loans borrowed through the William D. Ford Direct Loan Program can be forgiven after 120 qualified payments. Furthermore, all of your Perkins loan and part of your Stafford loan can be forgiven if you work full-time for five years as a teacher at certain low-income schools.

2) Joining the military

Different branches of the Armed Forces offer loan forgiveness programs. The extent of the loan forgiveness can correspond to your achievements, such as what rank you attain.

3) Loan deferral options

If you enlist in a graduate school program, join the Peace Corps or the military, or are unemployed, you could qualify for deferrals on your loan.

4) An advantageous repayment plan

There are different repayment plan options available to people who are stuck with seemingly unmanageable amounts of student loan debt. As mentioned in the USA Today article, the Income-Based Repayment Plan makes an adjustment to the amount of loans you have to pay per month, so as not to exceed 15% of your discretionary income (the amount of your income that puts you above the federal poverty line).

5) Bankruptcy

Generally, student loans can't be discharged through bankruptcy. There are some relatively rare cases where a bankruptcy court might make an exception for you, as when you file for Chapter 7 bankruptcy and claim 'undue hardship.' With undue hardship, you need to demonstrate that you're in severe financial straits; you have attempted to repay your loans, but you're struggling to pay for basic living expenses, and your situation is unlikely to improve within the near future. As for Chapter 13 bankruptcy, it may help you deal with student loans by reducing the monthly payments you need to make and giving you a time frame for repayment that has more breathing room.

If you're having trouble sorting through these options, don't hesitate to contact us to find the solution that works best for you. There are some people who make the mistake of calling on the assistance of dubious debt relief companies who wind up putting them deeper in debt and giving them disastrous advice. Instead, consider these legitimate options for loan forgiveness and other kinds of student debt relief, and discuss them with debt experts.