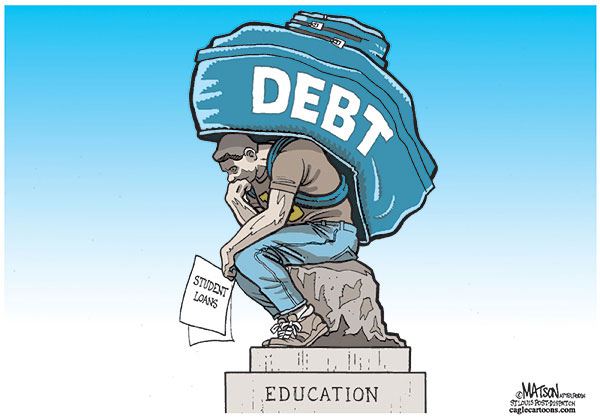

Nearly all debtors do not have the authority to discharge a student loan debt. However, you can experience this benefit by proving that repayment of a student loan would cause hardship. It is possible that an agent can get rid of this debt in a chapter 7 bankruptcy.

Myth #1: No courts allow student loans to be included in a legal proceeding.

According to the Law Offices of James C. Shields, many courts base their qualifications using the Brunner Test to demonstrate undue hardship. If an individual has a low income or a loan is from a for-profit school, a person increases their chance to include this debt.

Another qualification is to allow an individual to show proof of their current income and provide a list of expenses that demonstrates why an individual cannot maintain a quality standard of living. This financial situation of poverty will more than likely continue during the repayment period. A good faith effort has been made to repay their student loans.

Myth #2: The standards listed for Undue Hardship make it burdensome for many people.

Consumers who were able to discharge their student loans had these three characteristics:

1. A person is less likely to get hired for a job.

2. A medical hardship will happen in the future.

3. The year before a person filed for a bankruptcy their annual income was low.

Myth #3: Most people do not have their student loan debt discharged.

More consumers should include student loans in a bankruptcy even though the majority may not receive a discharge. However, many individuals will receive a relief to allow them to move forward with their lives financially.

Those candidates were able to come to an agreement with their lender to settle their balances. For consumers, this process is a victory on how to handle student loan debts that is unmanageable.

There are a number of reasons that explains why most people do not attempt to discharge their student loans under bankruptcy. The myth that any debt attempted to receive an education cannot be pursued in a court system.

If you need a bankruptcy attorney, contact us today and request a free consultation.